As you read this article, it is likely that you are already investing in Mutual Funds or at least planning to. Mutual Funds are now a household name in India but investors might be unfamiliar with some of the jargons. Even if you are investing for some time, you might be unfamiliar with some terms or wish to know more. In this article we will discuss some common terms associated with Mutual Funds.

- Asset Management Company: Mutual Funds are established as a Trust. The mutual fund trusts are created by one or more sponsors who are the main persons behind the business. However, the day-to-day functioning is handled by the AMCs. They manage the investor’s money and related activities like marketing, accounting etc.

- Unit: The smallest portion of ownership in mutual funds is called Units. When you invest in a mutual fund scheme you end up buying units of that scheme. The number of units you are allotted is ascertained by dividing your invested amount by the NAV of the scheme after adjusting for the expenses.

- Net Asset Value – NAV: This is the price at which you buy or sell your units in mutual funds. It is the market value of the scheme and is quoted per unit. NAV thus quoted is dynamic and is calculated by dividing the market value of all the securities of the scheme with all the units of the scheme. NAV = (Total Assets – Total Liabilities)/Outstanding Units of the scheme. NAV of a mutual fund scheme is declared end of trading day.

- Expense Ratio: To manage a mutual fund scheme the fund houses incur several expenses. These expenses are billed to the investors even before allotment thus units are allotted after deducting the expenses. The Expense Ratio of a scheme measures the per unit cost of managing a mutual fund scheme and is calculated by dividing the total expenses of the fund with total assets under management and is expressed in percentage terms.

- Folio: It is a unique number identifying your account with the mutual fund house. You may have multiple investments in a folio and multiple folios within a fund house too. In a way what account number is to your bank account, a folio number is to your mutual funds.

- Assets Under Management – AUM: Assets Under Management or AUM is the total market value of the assets and capital that a mutual fund house manages. Higher AUM may positively affect the liquidity of a fund hence is comforting to investors but not necessarily a pre-requisite to best future performance.

- Benchmark Index: A benchmark index is an Index against which the scheme performance is evaluated. Mutual Fund houses are mandated by the regulator to notify benchmark indices for all their schemes, so that investors have a benchmark to evaluate scheme performances. Such benchmark indices are in alignment with the investment objective, asset allocation and investment strategy of the scheme. Hence a Midcap mutual fund scheme may have a BSE 100 or NIFTY Midcap 150 as its benchmark and not BSE SENSEX or Nifty 50.

- Exit Load: Exit Load is a small fee charged by mutual fund houses to investors who exit a scheme before expiry of certain period from the investment date. Exit loads vary across schemes and asset classes and are levied to discourage exit within a certain period.

- Account Statement: Mutual funds issue detailed statements of transactions and valuations folio wise to investors. This statement usually known as Account Statement is sent to investor’s registered mail address within five business days of investing. In case of SIP/STP they are shared every quarter, though investors can access them directly from fund house websites. Account Statements also have a Transaction Slip attached.

- Consolidated Account Statement: Consolidated Account Statement or CAS is a single document of all your investment in the security market. It includes details of mutual fund holdings as well as direct equities in demat form.

- Factsheet: Factsheets are concise documents providing vital information about a mutual fund in an easy and presentable manner. Investors and potential investors use the factsheet to know, analyse and evaluate a mutual fund scheme. Content includes scheme performance, fees, concise portfolio, fund manager details and few more vital information. Factsheets are issued monthly by fund houses and this single document has contents presented scheme wise.

- Equity Fund: An Equity Mutual Fund is a mutual fund that predominantly invests in shares of companies. They are either actively managed or passively managed. Actively Managed funds depend on the fund manager’s expertise and active role whereas the Passively Managed funds replicate a particular Index where scheme performance mirror the specific index.

- Debt Fund: Debt funds are mutual fund schemes which invest primarily in Debt instruments. They do not have equity in their portfolio. Debt funds investing in cash and cash equivalent liquid instruments are called Money Market instruments.

- Hybrid Funds: Hybrid Funds are a variety of mutual funds which invest in both equity and debt instruments. Hybrid funds investing predominantly in equities with the balance in debt are called Equity Oriented Hybrid Funds whereas funds investing predominantly in Debt instruments are called Debt Oriented Hybrid Funds. Some hybrid funds invest in a third asset class like gold and are termed as Multi-Asset mutual funds.

- Systematic Investment Plan – SIP: SIP is a popular route to invest in mutual funds. You invest regularly & systematically from your salary or monthly income in a fund of your choice at a fixed date and fixed interval. SIPs are done mostly monthly though other interval options are available. MF Tools – SIP

- Systematic Transfer Plan – STP: Similar to SIP, STP is a systematic way to transfer a fixed amount from one fund to another within the same mutual fund house. If you have a lumpsum to invest in mutual funds and you are wary of volatility, you may park your corpus in a liquid fund and transfer fixed amounts at fixed intervals to your target fund, usually an equity fund. STP allows you a gradual entry in the securities market over a period of few weeks or months as against one lumpsum investment. MF Tools – STP

- Systematic Withdrawal Plan – SWP: Systematic Withdrawal Plan is the reverse of an SIP. In a SWP, you withdraw a fixed amount regularly and often perpetually from your mutual fund to fund your regular income. The withdrawal is fixed at a rate which is slightly lower than the expected rate of your fund, which is usually a hybrid fund though technically SWP can be availed from a debt or equity fund too. MF

- NFO: New Fund Offer or NFO is the first subscription offer that mutual funds offer to the public on launch of a new scheme. NFO are usually issued at face value of the scheme. MF Tools – SWP

- Asset Allocation: Asset Allocation is an investment strategy that aims to distribute your investments across different asset classes. There are four major asset categories, Fixed Income, Equities, Commodities and Real Estate. Asset allocation helps investors reduce risk through diversification. It is also noted that different assets can perform better at different times, hence asset allocation also allows investors balance risk and reward.

- Returns: Returns in mutual funds are by way of NAV appreciation or by dividend declaration or both. Returns may be ascertained by calculating Absolute Return or Compounded Annual Growth Rate(CAGR) or XIRR(Extended Internal Rate of Return. Mutual Fund factsheets mention scheme returns and so does portfolio valuation reports as generated by many intermediaries.

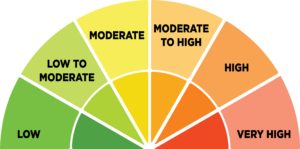

- Riskometer: Riskometer is a pictorial depiction of Risk in a mutual fund scheme. Mutual fund schemes carry different levels of risk and riskometer explains the associated risk in a simple manner. First introduced in 2015, the Riskometer was modified in 2020. Currently Riskometer has six levels of risk ranging from low risk to very high risk.

- Absolute Return: Absolute Return, as the name suggests, measures the return generated by the scheme between just two dates. It is the simplest measure of scheme performance and obviously does not take into account the time lapsed.

- Annualized Returns: Also known as Compounded Annual Growth Rate or CAGR, measures the return the scheme has generated annually or in annual terms.

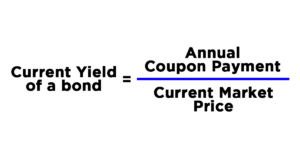

- Coupon: Coupon is the rate of interest paid in a bond to the holder of the bond by the issuer. It is paid as a percentage of the face value of the bond. Since bonds are transacted in secondary market, the yield of a bond is often different from the coupon and is calculated by dividing the Coupon with the Market Price of the bond.

- Average Maturity: Debt funds invest in multiple securities and each bond or security has an independent tenure or residual maturity. Average Maturity is the weighted maturities of all the current maturities in a debt fund and helps determining the average time to maturity of all the debt instruments in the portfolio. While selecting a Debt Fund, ensure that the Average Maturity of the fund aligns with your possible investment tenure.

- Yield to Maturity – YTM: Bonds yield are ascertained by dividing the Bond Coupon with the current market price. Yield to Maturity or YTM informs us the total return that a bond can give us if held till maturity. YTM of a Debt Fund is the likely return the fund will generate if held till the average maturity of the fund. The YTM however is a dynamic number and can change a bit.

Read More: