Insure Save Invest

Insurance purchase should ideally precede investing for the future. This will insulate your future wealth from depletion due to possible contingencies. Ensure adequate savings before embarking on investing for the future. Once ready, our digital platforms will help execute your investment decisions.

Choose the right scheme

With a large variety of schemes and plans at offer identifying the “Right Scheme” may be daunting. Best funds, Top three funds and similar recommendations though sought after often end up compounding the problem. We provide enough information from our website and mobile application empowering you to choose your preferred scheme. At Sudipta Sengupta we do not recommend schemes but are happy executing your recommendations.

Post Purchase Services

Handling investments post-purchase is key and can be challenging for most busy investors. At Sudipta Sengupta, we pledge to provide all investment related services and stay the course. Digital transaction options, scheme related details, accessing your investment details 24 * 7 all from our web platform and mobile application enhance investing experience. Our industry standard reports and web-based MIS empower you with the relevant information to track and handle your investments in your busy schedule.

Why choose us?

“Investing is simple but not easy” – Warren Buffet.

We make it easier for you by providing simple solutions, back it up by quality after sales support and stay the course.

Dedicated Manager

At Sudipta Sengupta, your Relationship Manager is your after sales support manager and will not request fresh investments in lieu of services offered.

Long-Term Relationship

You will find us when your investments mature or need to be redeemed as much as when you bought them. We shy away from sales targets instead focusing more on lifetime value of clients.

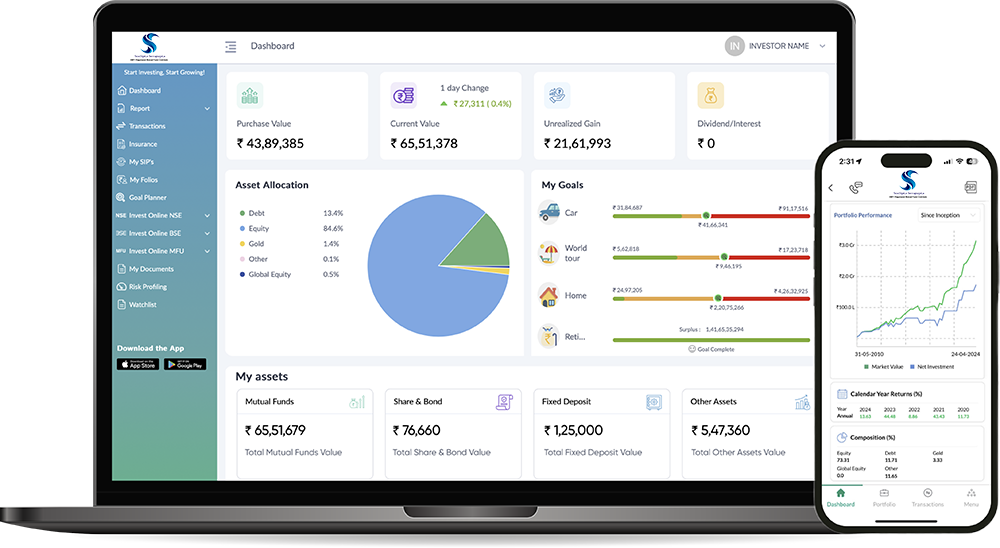

Online Investment Platform

Transactions with us will be largely online. You will be empowered to independently transact on your mutual funds. Additionally, through web login and mobile app you can track your investments and investment related information 24 x 7

Regular Reporting

Our clients will regularly receive detailed reports related to their investments and benefit from our MIS. This will help them make better choices and enhance portfolio quality.

Invest with a Purpose

Wealth Creation

It helps you visualize the amount accumulated with a Regular Investment at a specified rate

Children Wedding

This planner helps you see the future expenditure which would be incurred at the time of marriage

Client Testimonials

"I met Sudipta Sengupta in 2014.I found him knowledgeable & candid. It is truly refreshing to work with a financial advisor, who is truly interested in their client’s needs, circumstanced and preferences. What really impressed me was the way you took the time to get a feeling for where I was at, his knowledge, lateral thinking and common sense approach. Since then I have recommended Sudipta to other colleagues who I found were equally satisfied."

Dr. Sudip Roy

Consultant Microbiologist, Medica Superspeciality Hospital, Kolkata

"This is to thank Mr Sudipta Sengupta for being so organised and methodical in offering me methodical solutions. Thanks to him, I have a decent investment plan & strategy to protect me and family in case of any unforeseen eventuality. I have also trusted him to manage my Mutual Fund portfolio."

Dr. Debadeep Chakravarty

BDS, FDSRCS(England) - Consultant Oral & Maxilofacial Surgeon, Kolkata

"Sudipta Sengupta gives sincere, honest and pragmatic advises regarding financial management of his clients. His advice usually doesn't let one down. He can anticipate depreciation and accordingly advice transfer of funds."

Dr. Arka Banerjee

Associate Professor, Department of Gastroenterology, IPGME&R, SSKM Hospital, Kolkata

"It has been wonderful to be associated with Mr.Sengupta for the last few years. His in-depth knowledge regarding intricacies in financial management and his valuable guidance in wealth building, has been really helpful. He understands one's limitations and help in planning accordingly. His personalized attention and constant updates speak volumes of the person's professionalism. I highly recommend him to all my close associates,family members and friends. "

Dr. Abhishek Mukherjee

Consultant Pathologist, Kolkata

"The services rendered are absolutely essential for people who have very little time to focus and decide on matters of future investments, health and insurance. Even today despite the easily available knowledge and the ease of transactions, many people shirk these issues mainly due to lack of confidence and difficulties in choosing the better options. I feel this group of very fine people does help a lot of us who have not been able to focus on future security, health, financial, pension wise. It gives me pleasure having known these fantastic people who have helped me plan my finances as per my understanding and requirements. We have several miles yet to go. May they continue to help hundreds of others."

Dr. Gaurav Goswami

Consultant Oncologist, Apex Hospital, Varanasi

"The most important quality that an investment consultant should have is credibility. If the customer is not confident with his investment consultant then the investment plans would not work out. It is in this respect, I think Mr. Sudipta Sengupta scored passed all others whom I came across. Besides he is smart, eloquent and has a good knowledge of the subject. He is also very keen in clearly explaining all the investment plans he brings forward to his customers. I think he is worthy a person to be considered as one's investment consultant."

Dr. Rajib Sarkar

Associate Professor, Department of Gastroenterology, IPGME&R, SSKM Hospital, Kolkata

"When we started our journey with you, we really didn't have much idea about investing in mutual funds. We just knew that we wanted to invest. Where to invest and how to invest was something which was blurred to us. Here i would certainly say that our decision to carry our journey with you has been one smooth ride with all the headaches taken care by you. Right from the start, of you explaining to us about the whole process of investing in mutual funds was as lucid as it could have been.So our journey with you has been "as easy and as smooth as possible"We hope to grow together in the future."